Carbon Sequestration: Why it is important?

Apr 11, 2024

KEN SMITH, CEO

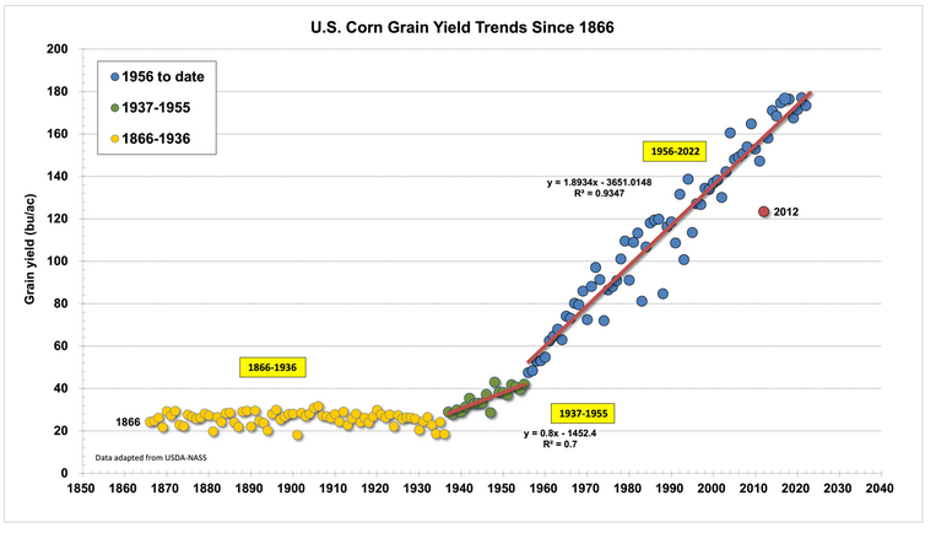

Row crop grain production has made significant strides in doing more with less. This can be seen in a corn yield curve over time. Technology gains have enabled more production on each acre while using fewer inputs.

We also see improved feed conversions for livestock (lower demand per animal). We are seeing this in beef, pork, and chicken. Genetic advancement in animals is one of the big drivers. Another ongoing development is South America’s grain production continues to grow. This comes both from yield improvements and from increased acreage. These factors add up, increase grain inventory levels, and reduce prices. Finding additional outlets and markets for corn is important. Ethanol has helped create additional demand over the last 15-20 years, but ethanol demand has been flat for several years.

Carbon sequestration can meaningfully impact an ethanol producer’s margin. As mentioned previously, one way an ethanol plant can capture the 45Z credits approved through the GREET model is through carbon capture sequestration. It appears that carbon sequestration can reduce CI by 30-31 points. There is an urgency to get in position for this. Those who don’t or can’t be positioned for this will be in a difficult position.

As a result of this dynamic, ethanol plants are looking for geological formations that can hold carbon long-term. These spots are not common. This has led to the development of a transportation system by pipeline to get carbon to the right spot. Given the concentration of plants in the Western U.S., it makes sense for entities to work together. Summit Carbon Solutions has been a leader in navigating through this process.

Another key point for a reduced CI score is to position ethanol as a feedstock for sustainable aviation fuel (SAF). World jet fuel consumption is approaching 100 billion gallons in 2024. Countries around the world are incentivizing or mandating SAF. The Inflation Reduction Act targets a need for three billion gallons by 2030 in the U.S.

U.S. ethanol consumption has been relatively flat for the last ten years. SAF offers a large opportunity for ethanol and, ultimately, corn demand. A conversion process must occur because jet fuel has a greater energy density than ethanol. There are several methods, but the current thinking is it takes 1.7 gallons of ethanol to convert to one gallon of SAF. The U.S. has about a 25-billion-gallon jet fuel market. One meaningful way to reduce jet fuel's carbon footprint is to use SAF, and most airlines are looking for this opportunity.

Getting ethanol in position to be used for SAF is critical. Without carbon sequestration, it is challenging for ethanol produced in the U.S. to have a CI score low enough to be used as a feedstock for SAF. There are current tax incentives to help SAF producers, but the CI score is needed first to make this happen. Carbon sequestration is important.

Brazilian second-crop corn ethanol will compete for gallons of SAF feedstock. Their ethanol production methods and the ability to have a second crop give them a CI advantage. U.S. corn can compete with carbon sequestration, but it will be challenging without it. Current plans are in place for the first large-scale U.S. SAF plant to be built in a position to import Brazilian ethanol if the U.S. can’t supply it.

We are currently at a crucial point where there is a need for increased demand for U.S. corn. The use of Ethanol for SAF has the potential to revolutionize the industry. We have experienced multiple cycles in agriculture, but I strongly believe that the use of ethanol for SAF would bring about a major shift in demand. Additionally, I anticipate that we will witness both improvements in yield and an increase in acreage in various parts of the world. I wanted to bring attention to this opportunity as I believe it will make a significant difference in corn margins and impact you, our members directly.